|

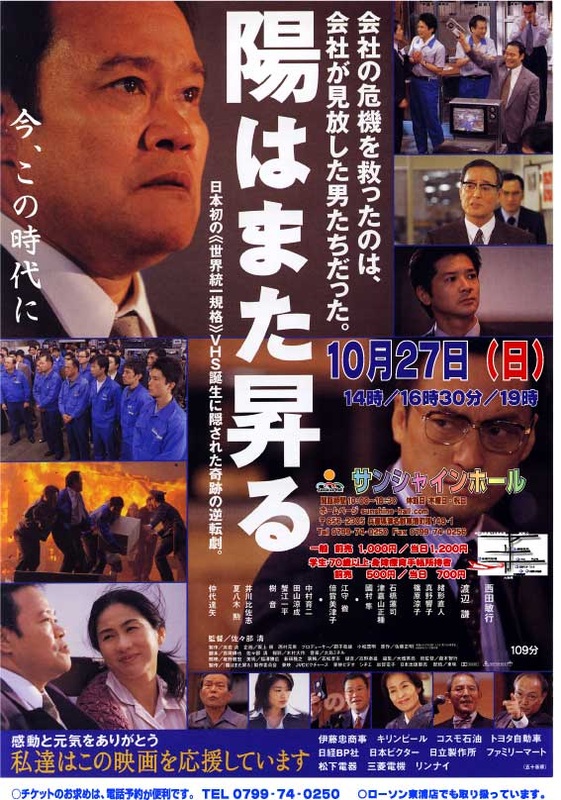

The Sun Also Rises (陽はまた昇る), starring Ken Watanabe (Westerner's will know him from The Last Samurai and Inception) is a great movie showing Japanese Leadership & Innovation at its finest -- in this case concerning the development of the VHS tape standard and VHS Video Tape Recorder by Victor Japan (JVC).

0 Comments

By James Santagata

Principal Consultant, SiliconEdge If it seems that we're under a constant barrage of the Western Media Myth (WMM) that (a) Japan is "failing" and that (b) this "failure" is primarily due to Japan's "talent problem" don't fret because we are. Further, we are told that Japan's supposed "lack of talent" has manifested itself in such as way as to be responsible for Japan's supposed "lack of creativity" and "lack of innovation"". But not to worry according to the WMM as we're then told that these "problems" that Japan faces can simply solved by (a) increasing the number of English-speaking Japanese and (b) internationalizing "backwards" Japanese-only speaking Japanese and (c) increasing the number of immigrants in Japan, preferably by engaging in a sort of US-Open Bordersfashion. .... .... The Western Media's argument or framing of the issues, especially in terms of Japan's supposed lack of "English-speaking" talent becomes even more silly when we consider that it ignores what I have deemed the "tip of the spear" or "tip of the sword" strategy. .... .... TOKYO — Caroline Kennedy arrived in Japan on Friday to take up her position as U.S. ambassador, the first woman to serve in the post and one who is from a political family familiar to many here.

"I bring greetings from President Obama," she said in after getting off the plane with her husband, Edwin Schlossberg, at Narita airport. "I am also proud to carry forward my father's legacy of public service," said the 55-year-old daughter of late President John F. Kennedy. "He had hoped to be the first U.S. president to visit Japan. So it is a special honor for me to be able to work to strengthen the close ties between our two great countries." Kennedy's appointment is being widely acclaimed here. As the daughter of the late president and an early supporter of President Obama, her selection is seen as reassurance of the special relationship between the two countries. We've talk about this here before, primarily focusing the the so-called three arrow of Abenomics and how it was misguided, misordered and worst of all, most likely untenable. - FirstPoint Japan Editor By Nathan Lewis, Contributor

Forbes Magazine The administration of Shinzo Abe in Japan just approved a rise in the consumption tax (national sales tax) to 8% in April 2014, from 5%. This opens the door for another rise to 10% in 2015. At the same time, the Abe administration plans to spend ¥5 trillion on “stimulus” to offset the negative economic effects of the tax. I’ve described a typical path of decline as a combination of “stimulus” and “austerity.” The “stimulus” mostly means spending money, or some kind of “easy money” policy. The “austerity” is some kind of tax hike. Put together, they add up to higher taxes, a moribund economy, more demands on the government as the private sector stumbles, more reliance by the government on distributing money as a way of bolstering political support, worsening finances, more waste, and a depreciating currency. .... This is completely contrary to the Magic Formula of Low Taxes, Stable Money — the formula that Japan itself used to grow wealthy during the 1950s and 1960s, and indeed in the 1870-1914 period as well. ... Most of the focus on “Abe-nomics” has been on the very aggressive monetary expansion being conducted by the Bank of Japan. To some degree this is warranted: the average yen exchange value over the past twenty years is about 120/dollar. However, once that point is reached … what then? I suspect that, soon, it will degenerate into not much more than a way of financing the flood of JGBs that still pours forth. I think most people understand now that the “stimulus” spending isn’t really about Keynesian notions anymore. Rather, it has devolved into the simple purchasing of political support. Perhaps it was never really more than that, but any other justifications have worn too thin to be credible. .... The spending was deemed necessary to preserve political support. When even that didn’t work, they spent more on the military to suppress revolt and revolution. As the private sector economy crumbled under ever-higher taxes, and successive currency devaluations, the king was not so popular anymore. His ministers feared that cutting off payments to nobles and other cronies might erode their base so much that the dynasty could crumble. ......... How much is ¥5 trillion in “stimulus”? It is more than half the total annual revenue of the corporate income tax, including prefectural and local taxes (about ¥9 trillion), or the projected amount of revenue expected to be generated by the increase in consumption taxes (about ¥6 trillion) — which won’t actually appear in any case. What if, instead of “stimulating” the economy by throwing money down a hole to appease cronies, you reduced tax rates instead? It might be popular. But, they never think of that. Nothing good is happening in Japan. Not much is likely to happen, until sometime after the present dingdongs reduce the economy to smoldering ruin. By James Santagata

Principal Consultant, SiliconEdge Richard Solomon of Beacon Reports recently wrote a very thoughtful piece first questioning and then analyzing the ability of Japanese firms to complete globally (see: Can Japanese Firms Compete In Global Markets?) I. Myths & Memes As so often happens with this and many other topics, ranging from war to innovation to relationships and dating, the question itself is beset if not hobbled with a series of Myths and Memes which we'll explore and unravel together in a series of future articles. II. Are Japanese Baseball Players Good Enough For Major League Baseball? My first thought upon reading this article was simply how it parallels this modern reality: Are Japanese baseball players good enough for major league baseball? Think about it. We used to ask this very same question about Japanese baseball players. Could Japanese baseball players make it in the major leagues? Sure, we all knew that the Japanese players were solid players, they were good, no one disputed that but we wanted to know could the Japanese baseball players really make it in the major leagues? (see: The New Age Of Japanese Baseball-Player Media Coverage Sam Robinson May 9, 2008) III. Can Japan Compete Globally On A Military Basis? From historical records we know that the Japanese can compete globally, industrially, cultural and, yes, even militarily. So let's start with the military perspective. Militarily, the fierce fighting tactics and spirits of Japanese soldiers during WWII lead to horrific allied battle casualties, both physical and psychological (see: Thousand Yard Stare), that in many cases easily outstripped what was encountered in the European theater (although there are obviously some exceptions). And, of course, some of the fiercest battles of WWII were held in the Pacific theater: Tarawa. Saipan. Midway. Coral Sea. Marshall Islands, Eniwetok. Guadalcanal. Iwo Jima, and, of course,Okinawa all come to mind along with the horrific casualties and loss of life among both soldiers and civilians. Roukan.com's Work Environment Surveys Solution Is Now An Official Sponsor of FirstPoint Japan8/24/2013 A big thanks goes out to Roukan.com as Roukan.com's Work Environment Surveys Solution Is Now An Official Sponsor of FirstPoint Japan.

If you've been attention lately you may have noticed that we've been in the process of completely rebooting FirstPoint Japan. We expect the full reboot to be completed by October 1st. Now, many have asked, "Why are you rebooting FirstPoint Japan and in what direction are you taking it?" The answer is this: FirstPoint Japan is being taken back to its original direction which was and is to serve as the first and only English-language portal that helps you Accelerate Your Japanese Business With Expert Advice™. Ultimately, FirstPoint Japan™ is to be the place Where Japanese Business Begins™. Specifically this means several things: 1. We will focus only on business related themes. Very rarely will consumer themes (e.g., what's the "hottest bar" or "best night spot") or "hey, isn't Japan weird?" themes be discussed unless such information is very relevant and would be of interest to our readers whereby they could better understand the Japan marketplace or cultural expectations. 2. The core readership for FirstPoint Japan is primarily Gaishikei (foreign firms) either entering the Japanese market, building out existing operations, accelerating growth, maintaining themselves in a sustaining phase or rebooting. 3. An additional target readership is (primarily) Japanese-language bilinguals (i.e., people of any nationality or ethnicity who are bilingual with one of their business level languages being Japanese) who are working for or would like to work for a gaishikei firm in Japan. 4. Given that Japanese firms are moving overseas and investing again in such operations again, another target readership is foreign individuals (non-Japanese or overseas Japanese) who are interested in working for a Japanese firm in a local market. For instance, such as a local person working for or interested in working for a Japanese firm like Honda in Vietnam. 5. The hottest topics previously as well as now include market entry and company build-outs. This centers much attention on issues such as hiring and the use of third party agency recruiters. Previously we maintained a large reviews database of "good eggs", "neutrals" and "bad eggs" recruiting agencies. However, since the industry is so opaque and "rough and tumble" (to put it mildly) we found ourselves spending an inordinate amount of time maintaining reviews that, for the most part, were just "bad egg" recruiting firms which was just a waste of everyone's time. We are now reversing the model. This means that now everything is considered and deemed suspect unless it is on FirstPoint Japan. We will be talking to, reviewing and placing on our site recruiting firms and other vendors with whom there is some level of trust, ethics and professionalism. By the same token, any vendor that isn't on this site you can approach at your own risk since we'll consider them "radioactive". The list will start out small, it may even remain small, but rest assured we do the best we can to vet the lists and collect feedback on the firms listed. 6. The vendor directory will include recruiting firms, training and coaching firms, paralegals and lawyers (incorporation paperwork, IP issues, visa issues and so on), accountants and CPA's, HR consultants, translators, interpreters and so on. We have a lot planned so we hope that you'll check back in frequently or if you'd like get the FirstPoint Japan Newsletter delivered straight to your inbox click on the button below. Sincerely yours, Publisher

FirstPoint Japan By Yoshito Hori President and Founder, GLOBIS I attend lots of conferences. Recently I spoke at the Milken Institute Global Conference in Los Angeles and the World Economic Forum on East Asia in Naypyidaw, Myanmar.

At both events, I sensed how interested the international community is in Japan’s ongoing economic recovery—and how much they want it to succeed. Of course, the man behind the long-awaited upturn in Japan’s fortunes is Shinzo Abe, prime minister since the end of December last year. From mid-November, when Abe launched his election campaign, he was clear about what he wanted to do: to change the whole “economic landscape” and end two decades of deflation and stagnation. Even before he won, Abe’s platform was bold enough to get the markets moving. The day the election was called, the stock market embarked on a multi-month rise of over 60%, and the yen a 25% fall. (And those numbers are despite a hefty correction in May!) The real estate market also rose, unemployment fell and GDP growth ticked up. Business sentiment is bullish too. In May, car company Toyota, a bellwether for Japanese industry, announced a near tripling of net profit to ¥1.3 trillion (US$13 billion). For this year, it’s forecasting profit growth of 36%, due partly to the tailwind of the weak yen. The media has dubbed Abe’s policy package “Abenomics.” It’s a catchy phrase, but—what does it actually mean? Let me take a stab at explaining. Abenomics consists of three core elements, nicknamed the “three arrows.” The first arrow is an aggressive monetary policy. Abe appointed Haruhiko Kuroda, former president of the Asian Development Bank, as governor of the Bank of Japan in March. Kuroda has set a target of achieving 2% inflation and doubling the money supply within two years. Abe’s second arrow is a proactive fiscal policy, consisting of a ¥10 trillion (US$100 billion) public works package. Meanwhile, the third arrow is a growth strategy. Structural reforms in Abe’s sights include everything from increasing women’s share of leadership positions to 30% by 2020 to joining the Trans-Pacific Partnership (TPP), a 12-country free-trade agreement that should drive trade liberalization and deregulation inside Japan. Far from frightening the electorate with this flurry of policies, Abe has maintained a support rate of around 70%, an astonishingly high level. (By contrast Barrack Obama stands at a lowly 45%!) Anyone who’s visited Japan since Abe’s election can sense that “change is in the air.” I genuinely believe that the mindset of the Japanese people is becoming more positive. As well being the dean of a business school, I chair a venture capital fund. That gives me a ringside seat on the Japanese economy. “Animal spirits” are very much in evidence. We’ve done two IPOs for Internet-related companies this year. In both cases the price tripled or quadrupled on the first day of trading. Japanese investors are also lining up to invest in our fund, where previously 80% of our money came from non-Japanese investors. Ayako Saiki, 15 June 2013 Abenomics is all the rage. Japan’s GDP grew at an annual rate of 3.5% in the first quarter, the stock market went up by almost 30% since December, and despite some uncertainties, sentiments, consumption, and exports are all picking up. However inflation is at -0.9% and survey-based inflation expectation has remained flat. Is inflation going to happen at all? This column argues the answer crucially hinges upon the implementation of structural reforms, especially in the labour market. Abenomics is all the rage.

Labour-market reform is the keyAccording to a survey by Reuters in February, 85% of responding firms said they would maintain current wage levels or make further cuts this year. Japanese companies typically resort to wage cuts for workers with so-called life-long employment contracts rather than lay-offs to adjust for cyclical downturns or due to tougher price competition from abroad. As a result, the unemployment rate has been low, but wages continue to decline. Due to the strong protection of permanent workers, firms typically have redundant permanent workers, thus have no incentive to increase their wages.

Worse yet, only a third of the Japanese labour force (typically older and male labour) has a permanent contract. The majority of the young and female labour force is working under a temporary contract with much lower salary and practically no job security, which creates a kind of caste system in the labour market. A permanent contract is especially hard to come-by for the younger generation and female workers. The youth unemployment rate in Japan is 8% (the total unemployment rate is 4.8%) as of 2011 according to the OECD, and the wage gap between male and female is the second worst among OECD economies. Three pillarsAbenomics is comprised of three pillars:

Prime Minister Shinzo Abe outlined on June 5 a sweeping blueprint for rejuvenating Japan's ailing economy with reforms meant to bring more women into the workforce, promote industrial innovation and coax cash-hoarding corporations into investing more.

The strategies Abe sketched out in a speech form the third and most important plank in his "Abenomics" platform, which so far has focused on what he calls the first "two arrows" in his arsenal: loosening monetary policy and boosting public spending. He has promised structural reforms to underpin growth in the long run as Japan's population ages and shrinks. "Now is the time for Japan to be an engine for world economic recovery," Abe said. "Japanese business, what is being asked is that you speed up. Do not fear risk, be determined and use your capacity for action." Without an overhaul of Japan's bureaucracy and its agricultural, industrial and labor policies, economists say Abenomics is bound to provide only a temporary boost to growth while vastly increasing the country's public debt burden. All agree that reforms are needed to break Japan free of the deflationary malaise that has stymied growth since its bubble economy collapsed more than 20 years ago and sustain growth in the future. Investors appeared unimpressed: the benchmark Nikkei index, which had slipped 0.3 percent in the morning ahead of the speech, was down 1.1 percent just afterward. The Nikkei had gained over 70 percent since November on expectations that Abe's program would boost growth and corporate profits, but has lost nearly 20 percent in the past few weeks on growing uncertainty over how well the plans are working. Abe pledged on June 5 to raise Japanese incomes by 3 percent a year to protect consumers' purchasing power if the government meets its target of boosting inflation to 2 percent within two years. However, his speech was short on details of how to achieve that aim after more than two decades of economic stagnation. He also promised to raise Japan's per capita gross national income by more than 1.5 million yen ($14,970) in 10 years. It now is about $45,000 a year. So far the government has taken only piecemeal initiatives such as loosening controls on online sales of over-the-counter drugs. Abe intends to raise private investment in roads and to set up "strategic economic zones" where private companies will be allowed to operate public facilities such as airports. Abe has repeatedly stressed his desire to encourage more women to work by improving access to affordable child care and extending parental leave. He also has called for improved English language instruction and loosening of labor regulations that discourage job hopping. He did not discuss details of those plans in his speech. Abe had promised to present his reform proposals by mid-June, a month ahead of an election for the upper house of parliament that his Liberal Democratic Party is determined to win--possibly assuring Abe another three years in office. But amid the recent volatility in financial markets and questions over his resolve to follow through with reforms, he has offered repeated previews of what he has in mind. "The structural reforms are as important as the first two arrows," Sri Mulanyi Indrawati, a managing director of the World Bank, told a recent conference in Tokyo. Abe has made reviving the economy his top priority since taking office nearly six months ago, so far with mixed results. The economy grew at a 3.5 percent annual rate in the first quarter, while a weakening yen helped boost the repatriated profits of big Japanese corporations. But despite rising costs for imported energy and food, overall prices have remained flat, and despite massive purchases of government bonds meant to pump cash into the economy, the central bank remains far from achieving its 2 percent target for inflation. Though most economists have given Abe's initial efforts a thumbs-up, it is the longer-term reforms that will really count, they say. "One thing is certain about growth policy: there is no silver bullet or panacea," said Masazumi Wakatabe of Waseda University. "In particular, contrary to the popular view, industrial policy has rarely worked in Japan or in other countries." Defending Abenomics in a recent speech, economy minister Akira Amari said, "This time, strategy will be followed by action." "Instead of lowering the bar, this will be a growth strategy that will continue to evolve," Amari said. "The goal is to equip Japanese industry with the strengths it needs to compete." Many of the reform proposals aired so far, however, are incremental, technical changes, such as providing insurance for factories leasing equipment. Though Japan's plan to join the "Trans-Pacific Partnership," an Asian-Pacific regional trade pact, could provide some foreign pressure to modernize and open up protected farming and other areas, most changes would come years later, says Junji Nakagawa, an expert on the TPP at Tokyo University. Land and tax reforms to facilitate consolidation of small farms would help, but have proven politically daunting, and the pact will not have any immediate impact even on imports of rice, which are now subject to a nearly 800-percent tariff. "Maybe seven or five years from now, Japanese farmers may face real competition," Nakagawa said. |

About FirstPoint Japan"Where Japanese Business Begins™" Archives

December 2015

Categories

All

|

- What's New

- Table of Contents

- Overview

- Japan Expert Insights

- Japan Expert Interviews

- Japan Market Entry

- For Japan Hiring Managers

- For Japan Training Managers

- For Japan Recruiters

- Recruiters & Executive Search

- Training & Development

- Coaches & Consultants

- Human Resources Consultants

- Japan Jobs & Careers

- Japan Events

- Our Sponsors

- Advertise on FirstPointJapan

- Newsletters & Alerts

- The Japan Business Blog

- Resources

- Glossary of Terms

- Content Archives (Full)

- About

|

© Copyright 2007-2024 SiliconEdge™ Co., Ltd. All Rights Reserved. |

RSS Feed

RSS Feed