Ken is one of the premier recruiters in the social media and gaming space in Japan.

You can find extensive audio interviews with Ken here:

The Japanese Social Media & Gaming Business Trilogy With Ken Charles

1) Challenges & Opportunities In Japan's Tech, Startup & Gaming Industries

2) Deep Dive On Japan's Gaming Industry with Ken Charles

3) Deep Dive On Japan's Startup Industry with Ken Charles

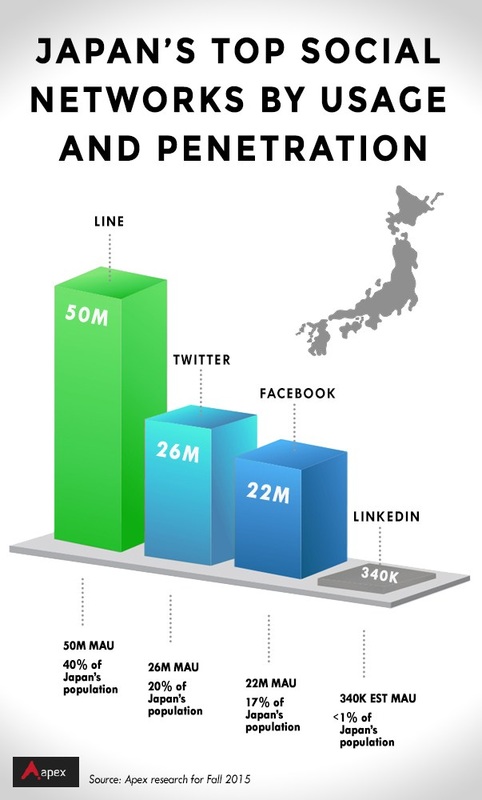

It’s a semi-enclosed greenhouse where Facebook flounders behind Twitter, and where LINE, a social network dominated by cartoonish stamps, rules. So with help from my local colleagues here in Tokyo, here’s the latest user data on Japan’s leading social networks, expressed in five key takeaways everyone in the Valley should know:

RSS Feed

RSS Feed